Your company operates in seven states. Three conform to bonus depreciation, two partially conform, and two completely decouple. If that sentence made you reach for the aspirin, you're not alone.

The dirty secret of the OBBBA's 100% bonus depreciation restoration? It might actually increase your total tax bill if you're not careful about state taxes. And here's what nobody's telling you: that's exactly where your opportunity lies.

While everyone else is blindly maximizing federal deductions, you could be engineering a strategy that cuts your combined federal and state tax burden by 30% or more. The key isn't choosing between Section 179 and bonus depreciation. It's knowing when each one gives you leverage at the state level that your competitors are missing.

Understanding fixed asset depreciation fundamentals across multiple state jurisdictions is the foundation for optimizing your tax position.

The Federal Gift That States Don't Want

Let's start with an uncomfortable truth. States need revenue, and they're increasingly viewing federal bonus depreciation as a raid on their treasuries. When the OBBBA made 100% bonus depreciation permanent, state revenue departments didn't celebrate. They strategized.

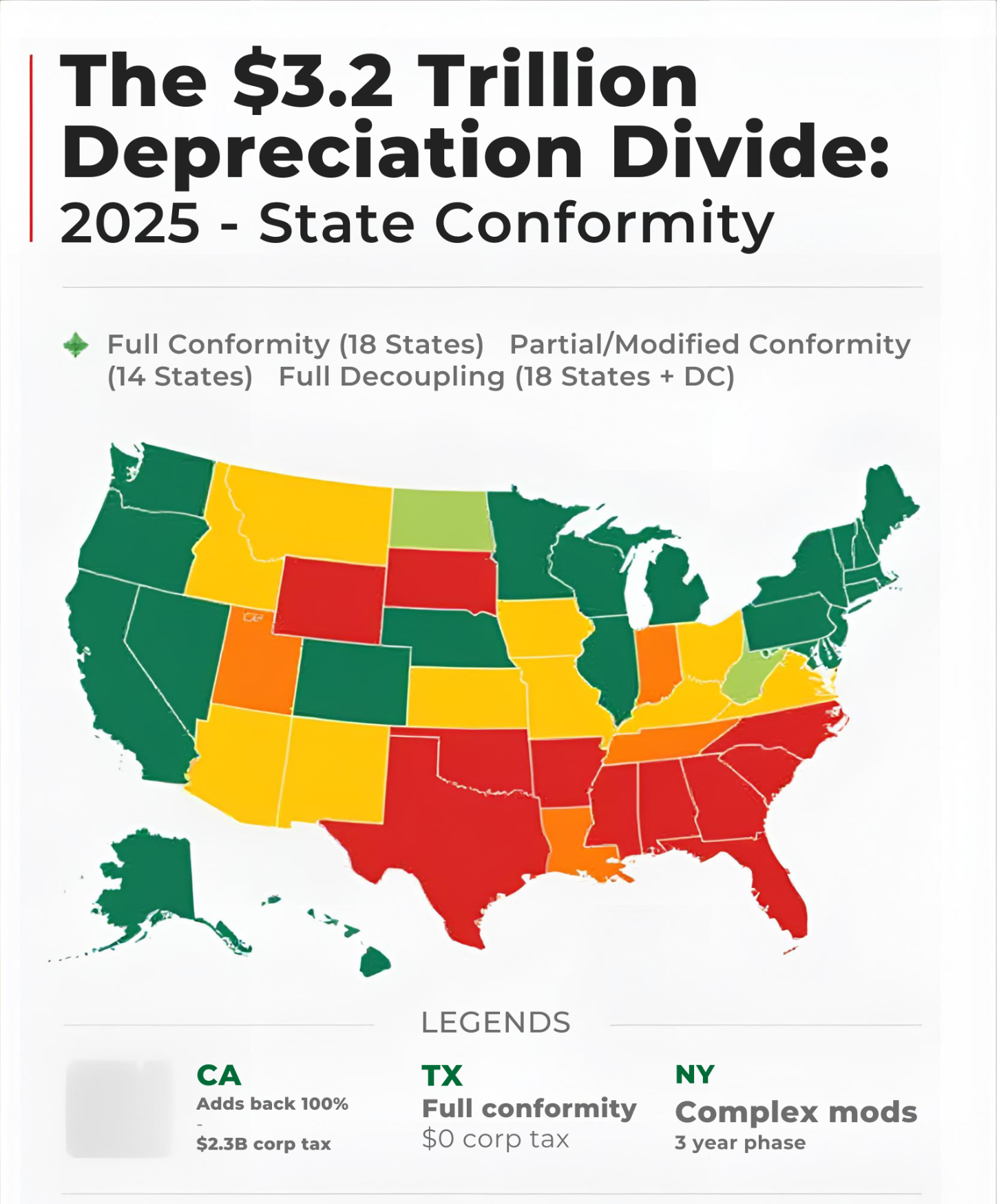

California adds back 100% of your bonus depreciation. New York modifies it. Pennsylvania has its own depreciation system entirely. Meanwhile, Texas happily conforms because, well, they don't have a corporate income tax to worry about. This patchwork isn't random—it's deliberate.

States watched federal bonus depreciation drain billions from their budgets during the TCJA years. Their response? Systematic decoupling. In 2017, only 13 states fully decoupled from federal bonus depreciation. Today? That number has more than doubled, with several more considering changes for 2026.

According to Bloomberg Tax research, calculating state bonus depreciation modifications has become one of the most complex compliance challenges for multistate corporations.

The timing couldn't be worse for multi-state businesses. Just as federal tax policy offers unprecedented depreciation benefits, state tax policy is moving in the opposite direction. You're caught between a federal government encouraging capital investment and state governments protecting their revenue base.

But here's what makes this interesting: Section 179 hasn't faced the same backlash. Most states that reject bonus depreciation still conform to Section 179. There's your arbitrage opportunity, hiding in plain sight.

Successfully navigating these complexities requires robust fixed asset management systems that track federal and state depreciation simultaneously.

Understanding the State Conformity Landscape

Forget the simple "conforms/doesn't conform" binary you see in basic tax guides. Real state conformity exists on a spectrum, and understanding where each state falls can save you millions.

Full Conformity States

Full Conformity States are becoming endangered species. As of 2025, only 18 states fully conform to federal bonus depreciation without modifications. Even among these, several impose subtle limitations through related provisions.

Delaware conforms but imposes gross receipts taxes that ignore depreciation entirely. Alaska conforms at the state level but allows local jurisdictions to decouple.

Partial Conformity States

Partial Conformity States are where complexity lives. Take Arizona—they conform to bonus depreciation but only for assets with a class life of 10 years or less. Illinois conforms but requires you to add back federal depreciation, then subtract their own version.

Wisconsin allows bonus depreciation but caps it at $25,000 per asset. These aren't loopholes; they're deliberately crafted compromises between economic development goals and revenue needs.

Full Decoupling States

Full Decoupling States are actually the simplest to plan for, paradoxically. California, New York, and New Jersey require complete addback of bonus depreciation. No exceptions, no negotiations. But they generally accept Section 179 expensing, creating a clear planning opportunity.

The real complexity? States change their positions annually, sometimes retroactively. Maryland modified their conformity rules three times between 2022 and 2024. Connecticut announced their 2025 position in December 2024. If you're not tracking these changes in real-time, you're planning with outdated maps.

The Tax Foundation reports that 12 states and the District of Columbia remain out of conformity with current federal expensing limits, putting small businesses at a competitive disadvantage.

The Section 179 Strategic Advantage

Here's the insight that separates sophisticated tax planning from mechanical compliance: Section 179's "limitations" are actually features when you're optimizing across multiple states.

That $2.5 million cap that seems restrictive compared to unlimited bonus depreciation? It forces you to be selective about which assets you expense, giving you control over your state modifications. The income limitation that prevents creating losses? It naturally smooths your taxable income across states with different tax rates.

Think about it strategically. In a state that decouples from bonus depreciation, every dollar of federal bonus creates a state addback modification. But Section 179? Usually flows through cleanly. On $2.5 million of qualified purchases, that difference is worth approximately $150,000 to $250,000 in state taxes, depending on your state mix.

The real leverage comes from Section 179's asset-by-asset election capability. Unlike bonus depreciation, which applies to entire asset classes, Section 179 lets you cherry-pick. Expense the assets located in conforming states, depreciate normally in non-conforming states. It's surgical precision versus a sledgehammer.

Even better? States rarely challenge Section 179 elections the way they scrutinize bonus depreciation claims. Revenue departments understand Section 179 as "small business relief", even when large corporations use it strategically.

There's less political pressure to limit it, less audit focus on it, and more stable treatment year to year. However, many businesses face common fixed asset management challenges when implementing multistate depreciation strategies without proper tracking systems.

Building Your Multi-State Depreciation Strategy

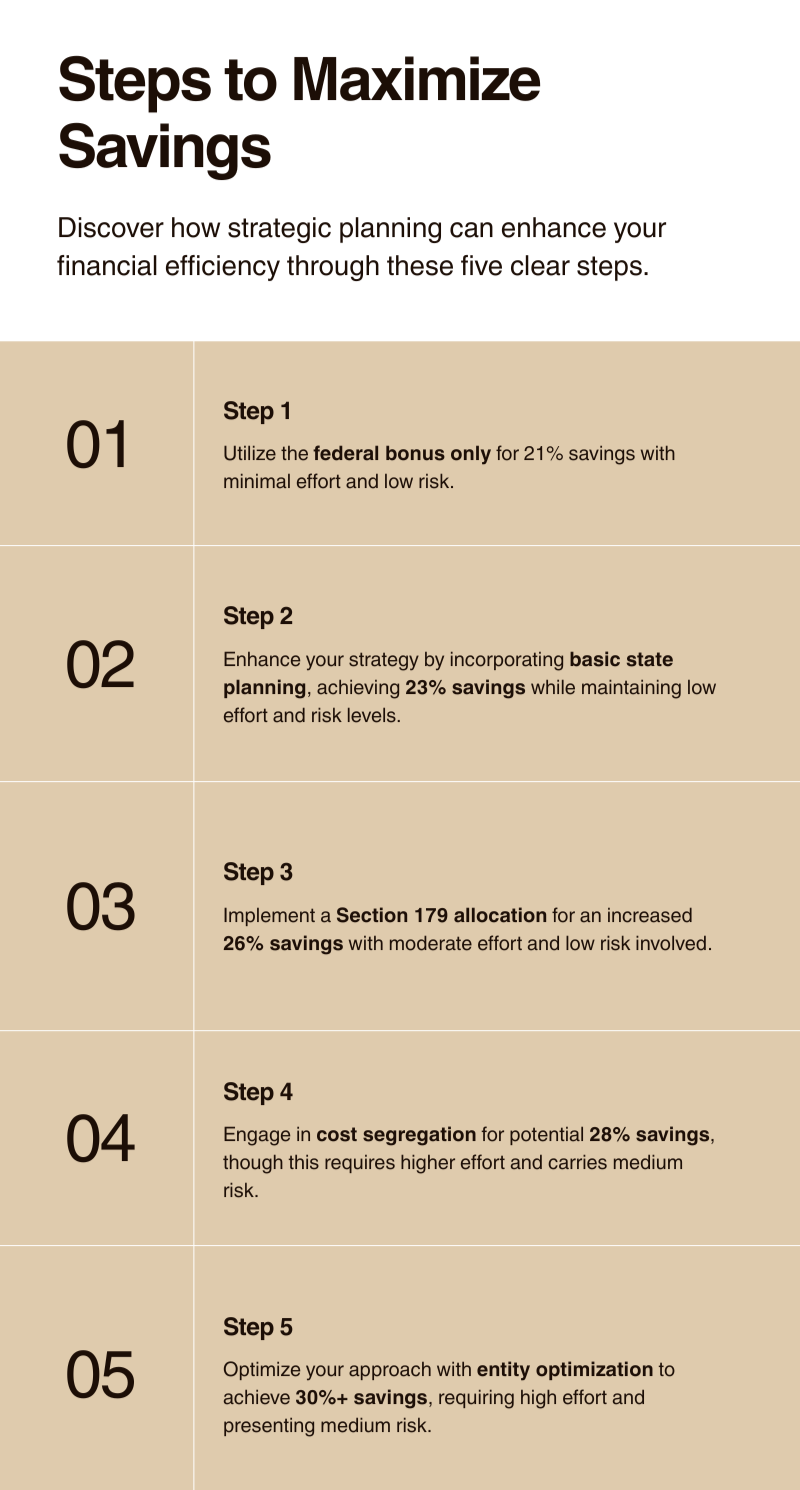

Stop thinking about depreciation as a federal-first decision. Your optimal multistate tax strategy starts with your worst state tax situation and works backward.

Layer 1: Identify Your Constraint State

Your constraint state isn't necessarily where you have the most property: it's where the tax cost of federal acceleration is highest. Usually, this is California (8.84% rate, full addback), New York (7.25%, substantial modifications), or New Jersey (11.5%, complete decoupling). This state determines your Section 179 allocation.

Layer 2: Optimize Your Home State

Your commercial domicile state typically gets your largest apportionment share. If it conforms to bonus but not Section 179 (rare but possible), flip your strategy. If it partially conforms to both, model the interaction effects. A 1% difference in effective rate might swing millions in NPV.

Layer 3: Manage Nexus States

For states where you have minimal presence, the calculation changes. Will aggressive depreciation push you below income thresholds? Could it affect throwback rules?

Sometimes taking less depreciation actually reduces your total tax burden through apportionment effects.

Decision Framework

Here's a decision framework that actually works:

IF constraint state fully decouples from bonus THEN

→ Use Section 179 up to $2.5M limit

→ Apply bonus only to conforming state property

IF constraint state partially conforms THEN

→ Model the modification calculation

→ Use Section 179 for assets exceeding state limits

→ Apply bonus to qualified assets below thresholds

ELSE (full conformity)

→ Maximize bonus depreciation

→ Reserve Section 179 for non-qualifying assets

The execution requires discipline. You need to track acquisition dates meticulously. Remember, the January 19, 2025 deadline for 100% bonus is federal only. States might have different effective dates.

You need to document asset locations accurately, as states can challenge deemed locations for mobile equipment. And you need to model not just Year 1 impact but the full recovery period, because state addback recapture rules vary wildly.

Learn more about navigating these complexities in our comprehensive OBBBA depreciation 2025-2026 guide.

Real Numbers: A Multi-State Case Study

Let's make this concrete with actual numbers from a client scenario (details modified for confidentiality).

A medical device manufacturer purchased $5 million in production equipment in Q3 2025. Operations in California (40% apportionment), Texas (35%), and Massachusetts (25%). Their federal rate is 21%, and they're modeling a 7% discount rate for NPV calculations.

Strategy A: Maximum Federal Bonus Depreciation

Federal tax savings Year 1: $1,050,000

California addback: $5,000,000 × 40% × 8.84% = $176,800 additional tax

Texas impact: $0 (no corporate income tax)

Massachusetts: Conforms, saves $5,000,000 × 25% × 8% = $100,000

Net Year 1 benefit: $973,200

Strategy B: Section 179 Optimization

Use Section 179 for $2,500,000

Federal tax savings on Section 179: $525,000

Federal bonus on remaining $2,500,000: $525,000

California: No addback on Section 179 portion, saves $88,400

Texas impact: $0

Massachusetts: Full benefit = $100,000

Net Year 1 benefit: $1,061,600

That's an $88,400 improvement - seemingly modest. But the real advantage emerges over time:

Five-Year NPV Analysis:

Strategy A creates massive Year 1 deductions but higher state taxes for 5+ years as modifications reverse

Strategy B smooths federal benefits while minimizing state friction

NPV advantage of Strategy B: $247,000

The lesson? Your competitors taking maximum federal bonus are leaving a quarter-million dollars on the table. Per transaction. Multiply that by your annual capital spending, and we're talking real money.

Advanced Tactics for Complex Operations

Once you've mastered the basics, three advanced strategies separate true optimization from mere compliance.

Cost Segregation in Decoupled States

Cost segregation studies typically accelerate 20-30% of building costs into shorter lives eligible for bonus depreciation. In decoupled states, this creates massive addback requirements. But combine cost segregation with Section 179, and you can expense the accelerated portion without state addback. On a $10 million property, that's worth $200,000-$300,000 in state tax savings.

The trick is sequencing. Complete your cost segregation study first, identify the 5, 7, and 15-year property, then allocate Section 179 specifically to those assets. Document this allocation meticulously - states will challenge perceived gaming.

Composite Return Optimization

If you're a pass-through entity with multi-state owners, composite returns add another dimension. Some states allow composite filers to use different depreciation methods than direct filers. Others require uniformity. Map your owner locations against state rules, and you might find opportunities to shift depreciation benefits to lower-tax owners.

Example: A private equity-owned LLC with partners in New York and Florida. Allocate Section 179 deductions to New York partners (offsetting high state taxes), while Florida partners (no state tax) take bonus depreciation. The composite return rules in most states permit this optimization if properly structured.

Managing Modification Worksheets

The administrative burden of state modifications isn't just about compliance. It's about audit defense. States increasingly use AI to flag suspicious modification patterns. Returns showing large bonus depreciation addbacks without corresponding Section 179 usage trigger reviews.

Best practice? Create parallel depreciation schedules from Day 1. Don't try to reconstruct state basis when audit notices arrive. Track federal bonus taken, state modifications required, Section 179 allocated, and regular MACRS depreciation. For each asset. In each state. Yes, it's complex—that's why it's valuable.

The Technology Gap Killing Your Optimization

Here's an uncomfortable truth: 73% of mid-market companies still track multi-state depreciation in Excel. That's inefficient and actively destroys value.

Manual state modification calculations have an error rate exceeding 15%, according to a 2024 Bloomberg Tax study. Each error either overstates tax (wasting cash) or understates it (creating audit exposure). The complexity compounds quarterly, as federal amendments, state law changes, and asset additions create versioning nightmares.

Consider what you're actually tracking:

• Federal depreciation per asset

• State modifications per asset per state

• Section 179 allocations with income limitations

• Bonus depreciation elections by class and year

• Cost segregation adjustments

• Disposal and recapture calculations

• Audit adjustments and amended returns

Now multiply that by your asset count, state count, and years open for audit. One client discovered their Excel-based system had 47,000 formula cells for just their California modifications. One broken link corrupted three years of calculations.

The answer isn't just "better spreadsheets." You need purpose-built depreciation software that understands state conformity rules, automates modification calculations, and maintains audit trails. The ROI is immediate—one prevented error pays for years of software costs.

This is where solutions like Bassets eDepreciation become essential. When you're managing different depreciation schedules across IRS, AMT, GAAP, and 20+ state systems simultaneously, manual tracking isn't just risky—it's impossible to optimize.

The software investment pays for itself through identified planning opportunities, not just error prevention. Many organizations that choose fixed asset software for small businesses find the ROI extends far beyond basic compliance.

Your Next Four Weeks

Stop treating state depreciation as a compliance afterthought. Your action plan:

Week 1: State Conformity Audit

Map your actual state footprint against current conformity rules. Not last year's rules—2025's actual positions. Include pending legislation and announced changes for 2026. You'll likely find surprises.

Week 2: Constraint State Analysis

Calculate your effective state tax rate on federal bonus depreciation. Include addback requirements, modification recapture, and apportionment effects. Identify your true constraint state—it might not be obvious.

Week 3: Section 179 Allocation Modeling

Run scenarios allocating your $2.5 million Section 179 capacity across different assets and states. Model both Year 1 and full-cycle impacts. The optimal allocation rarely matches your first instinct.

Week 4: Implementation Planning

Document your strategy, update fixed asset systems, and brief your team. State optimization requires coordination between tax, finance, and operations. Everyone needs to understand the plan.

The companies winning at multi-state tax planning aren't necessarily the ones with the lowest rates or biggest deductions. They're the ones who recognize that federal and state tax systems are diverging, and that divergence creates opportunity.

While your competitors chase federal benefits, you can engineer strategies that optimize your total tax position.

The OBBBA didn't just restore bonus depreciation. It created the widest federal-state depreciation gap in history. That gap is either a problem or an opportunity, depending on how you approach it.

Which side of that divide will you be on?

State Conformity Quick Reference

FAQs

Q: If my company operates in California but assets are used in Texas, which state's rules apply?

For depreciation modifications, the state where you have nexus and filing obligations applies their rules to assets included in your apportionment formula. California will require addback modifications even for Texas-located assets if they're included in your California property factor. However, strategic entity structuring can sometimes isolate assets in single-state entities.

Q: Can I make different Section 179 elections for federal versus state returns?

Generally, no. States that conform to Section 179 typically require you to use the same elections as federal. However, some states allow additional Section 179 amounts beyond federal limits, and you control the allocation of the federal $2.5 million limit across assets, which affects state impact.

Q: How do states treat the new Qualified Production Property (QPP) provisions?

Most states haven't specifically addressed QPP yet, creating uncertainty. States that conform to "the IRC as currently amended" likely allow it, while fixed-date conformity states might not. California and New York have indicated QPP will be treated like bonus depreciation (full addback). Plan conservatively until states clarify.

Q: What happens to state modifications when assets are sold?

Recapture rules vary dramatically by state. California requires immediate recapture of addback benefits. Illinois spreads it over remaining tax years. New Jersey has no recapture, creating permanent differences. Model dispositions carefully; the state tax impact might exceed federal recapture.

Q: Should pass-through entities make different decisions than C-corporations?

Absolutely. Pass-through entities must consider owner residency, composite return rules, and state withholding requirements. A Section 179 deduction flowing to a California resident partner might be worse than bonus depreciation flowing to a Texas resident, even from the same entity.

Simplify Multi-State Depreciation

When you're comparing fixed asset accounting software options, look for solutions that specifically handle multi-state depreciation tracking. Not all software is created equal especially when it comes to state conformity complexity.